Order book sharing to be banned on Korean exchanges

A portion of the enforcement decree to the Special Reporting Act stipulates that cryptocurrency exchanges operating in South Korea may no longer share order books or use shared order books. The decree comes into effect on March 25th of next year, but there is a chance its effective date may be expedited sooner.

Analysts expect small and medium-sized exchanges to suffer from the new decree.

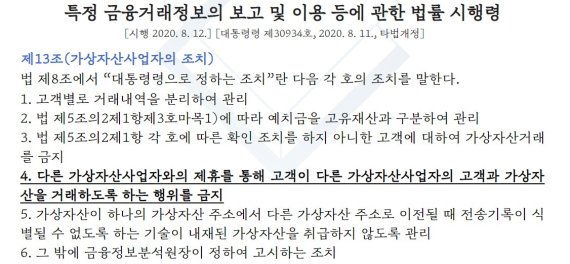

Article 13, section 4 of the amendment specifies that “[it is forbidden to allow its customers to trade virtual assets with customers of other virtual asset operators through partnerships with other virtual asset operators.]” Such a ban would quickly strangle small exchanges out that of the market who cannot survive without such order book-sharing arrangements.

The rule against shared order books used at domestic Korean exchanges also applies to orders shared from international exchanges. Such affected exchanges would be Binance KR, who use Binance’s order books, Bithumb Korea, who shares their order books with other Bithumb branches, Huobi Korea, who uses Huobi’s order books, and others.

Possible service deterioration or disruption

Shared order books provide tremendous verifiable liquidity to smaller-partner exchanges. That liquidity makes the platform more desirable for traders who want to ensure their orders get placed properly without being skipped over. Therefore, the impending regulatory change will likely cause services at exchanges to deteriorate and user satisfaction to plummet if exchanges can survive at all.

An exchange operator has already commented anonymously through Financial News that “[If the order book cannot be shared due to the enforcement of the Special Money Act, small and medium-sized exchanges will face a number of practical problems such as a reduction in trading volume and a burden on liquidity supply-]”

The comment from the exchange operator evokes some sense of urgency and desperation. They realize the difficult position the new law will put them in. Luckily for exchange operators, although the law comes into effect in March, there is a grace period of 6 months before all exchanges must absolutely comply with all of the rules.

Due to some apparent lack in specificity, the rule applies to many contract types between exchanges. In other words, there is no differentiation between merely supporting transaction matching through an API or through a settlement system. The significant difference between the two arrangements begs for revision which, at this stage in the Act’s implementation schedule, is unlikely to come.

Advice from the public, which can range to all extremes, has trended on the moderate side on this issue so far. They have urged the government to revise the amendment to accommodate a broader approach.

The stipulation has created an environment of even greater uncertainty about the future of the Korean crypto space. At one point, South Korea was the bona fide leader of the cryptocurrency trading world, accounting for some 30% of all global spot trades. It has since fallen from that mantle to feature zero exchanges even in the top 10 globally by trading volume as of today.